Overwhelmed by the endless demands of managing your bookkeeping? Our expert bookkeepers take that workload off your hands. We provide comprehensive bookkeeping services for small and medium sized businesses, ensuring accurate, timely, and efficient financial management to help your business thrive.

Our chartered accountants handle everything from daily transaction recording and reconciliation to regular management reporting, audit support, and more, keeping your books in perfect order.

Whether you need outsourced, in-house, hybrid, or transitional services for shifting to in-house bookkeeping, we offer tailored solutions to streamline your business operation.

OUR BOOKKEEPING SERVICES

Daily Transaction Recording and Expense Tracking

At Accountant Globe, we meticulously record every transaction to keep your financial records current. We also track your expenses closely.

Accounts Payable and Receivable Management

We manage all aspects of your payable and receivable, ensuring timely invoicing, billing, payments and credit control support (if needed).

Bank Reconciliation, and More

We offer bank, credit card, loan, and balance sheet reconciliation (if needed). By aligning your statements with internal records, we resolve discrepancies and provide a clear view of your financial health.

Bookkeeping and Accounting Tools

Our team is skilled in various bookkeeping and accounting software, including QuickBooks, Xero, and Sage, as well as ERP systems like NetSuite and Maconomy. We adapt to your preferred tools for efficient financial management.

Additionally, we offer expert advice on selecting and configuring the best accounting system for your business and assist with smooth migrations to new platforms when needed.

Switching from Existing Accountant

At Accountant Globe, we’re committed to making your transition to our bookkeeping services as smooth as possible. Simply notify your current accountant, and we’ll help you request the necessary records for a seamless handover. Our team will create a clear transition plan, ensuring your financial data is organized and ready for us to take over.

We prioritise open communication to understand your unique business needs and tailor our services accordingly. After the transition, we welcome your feedback to ensure our services exceed your expectations. Let Accountant Globe streamline your financial processes and support your business growth!

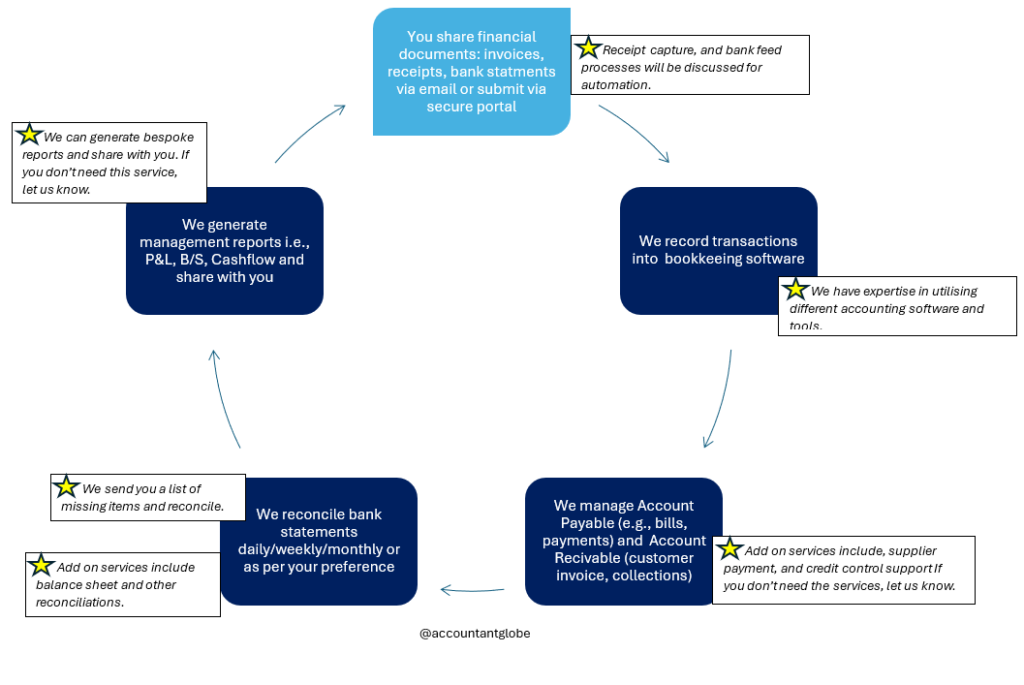

The diagram below illustrates our bookkeeping process

Additional Bookkeeping Services

Preparing Trial balance

Our meticulous trial balance preparation ensures your accounts are perfectly balanced, providing a solid foundation for accurate financial statements and informed business decisions.

Cash Flow Management

Effective cash flow management is crucial for ensuring business sustainability and growth. We closely monitor your cash flow to help you manage daily financial operations, anticipate future cash needs, and maintain healthy liquidity levels.

Audit Liaison and Support

We offer end-to-end audit support, from pre-audit preparation to post-audit follow-up. Our team ensures you are audit-ready, compiling all necessary documentation, assisting during on-site audits, and liaising with auditors to ensure compliance and efficiency.

Inventory Management and Reconciliation

If your business requires inventory management, we assist with inventory-heavy operations by implementing efficient tracking and reconciliation processes, ensuring your stock levels align with sales and purchasing records.

Month-end, Quarter-end, Year-end Accounting

Accountant Globe delivers efficient month-end, quarter-end, and year-end accounting services. Our chartered accountants reconcile accounts, and generate financial statements on monthly, quarterly, and annual cycles ensuring compliance, while providing comprehensive tax and audit support.

Transition to In-House Bookkeeping

If you’re considering bringing bookkeeping and accounting in-house, Accountant Globe offer:

![]() System Setup: Accountant Globe Assists you in selecting and implementing the right bookkeeping software for your business needs.

System Setup: Accountant Globe Assists you in selecting and implementing the right bookkeeping software for your business needs.![]() Hiring internal staff: We help you identify and recruit the ideal candidates for your accounting team.

Hiring internal staff: We help you identify and recruit the ideal candidates for your accounting team.![]() Process Development: We design and implement streamlined bookkeeping processes, systems, and reporting tailored to your business requirements.

Process Development: We design and implement streamlined bookkeeping processes, systems, and reporting tailored to your business requirements.![]() Training: We deliver in-depth training for your staff, equipping them with the skills and knowledge necessary for a seamless transition from outsourced to in-house bookkeeping.

Training: We deliver in-depth training for your staff, equipping them with the skills and knowledge necessary for a seamless transition from outsourced to in-house bookkeeping.![]() Ongoing Support: We provide continuous support to ensure your internal team remains confident and capable in managing financial operations effectively.

Ongoing Support: We provide continuous support to ensure your internal team remains confident and capable in managing financial operations effectively.

Why Choose

Us?

Us?

Access to chartered Accountants and expert advisors

Weekly, monthly quarterly and yearly bookkeeping services tailored to your business operation needs

Timely and precise bookkeeping delivery

Flexible outsource, in-house or hybrid model

Comprehensive bookkeeping services from record to report and audit support

Expert accounting software and system set-up

Tailored solutions for small to medium-sized businesses, start-ups, scale-ups, and established companies

Outsource to in-house bookkeeping transition services

Frequently Asked Questions and Answers

When choosing bookkeeping software, popular options include QuickBooks Online for its versatility, Xero for its flexible plans, and FreshBooks for its freelancer focus.

Ensure the software aligns with your business size, accounting complexity, and budget while assessing ease of use, integration, mobile access, and compliance with Making Tax Digital regulations. Utilize free trials to confirm it meets your needs. Accountant Globe can assist with selecting, implementing, and configuring the best accounting tool for your business.

Outsourcing your bookkeeping provides access to expert accountants who deliver tailored financial strategies and meticulous record management, addressing time-consuming tasks, inaccuracies, and compliance issues.

Outsourcing not only cuts costs but also frees your time for core business growth. Scalable solutions streamline financial processes, enhance cash flow management, and support better decision-making.

For startups and large enterprises alike, outsourced bookkeeping is a smart investment in your financial health, delivering insights and accuracy that internal teams may struggle to achieve. Leveraging external expertise gives you a competitive edge, ensuring your finances are managed efficiently and effectively, propelling your business forward.