Accountant Globe offers bespoke, cost-effective payroll services for small to medium-sized businesses in the UK.

Whether you’re a start-up hiring for the first time or an established company seeking partial or full payroll outsourcing, our expert accountants provide tailored solutions that save you money, reduce administrative tasks, and ensure compliance with the latest tax regulations.

Contact Accountant Globe to simplify your payroll processes and empower your business to thrive!

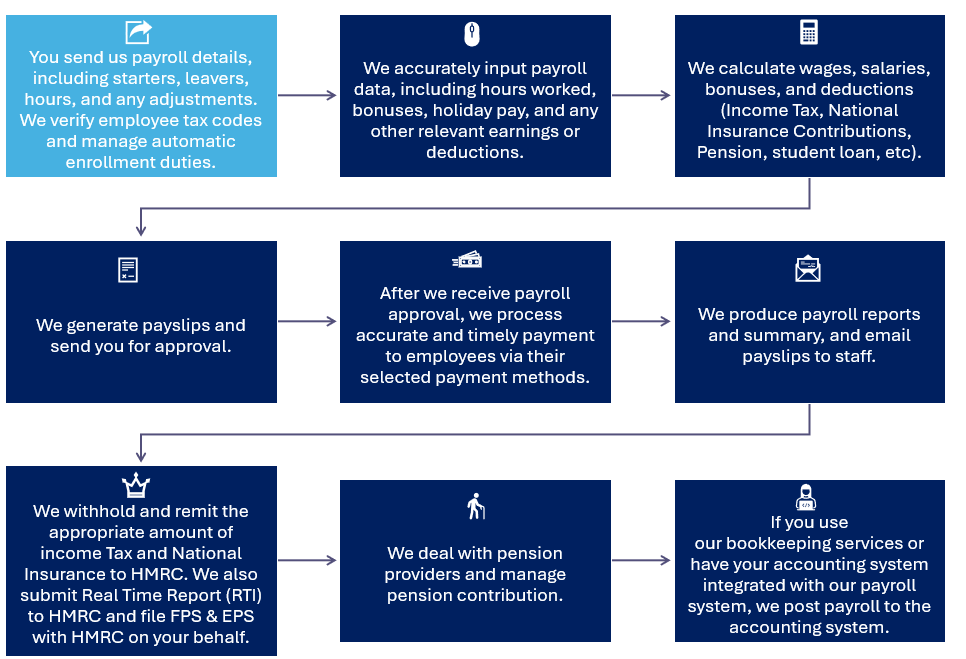

How We Do It?

1. Initial Consultation

We start by assessing your current payroll process to understand your specific needs, including payroll schedules, employee classifications, payment methods, and reporting requirements. For first-time payrolls, we also assist with HMRC registration and compliance.

2. Initial Payroll Setup

We configure your payroll system by setting up employee data, variable hours, overtime, bonuses, joiners, leavers, sick days, holidays, commissions, payment methods, schedules, and auto-enrolment. We ensure full compliance with regulations, including proper tax code and National Insurance category setup. Additionally, we register as your payroll agent with HMRC and verify your PAYE scheme.

3. Software Integration

We can integrate with your existing human resources (HR) and accounting systems, streamlining data exchange and simplifying reporting across departments.

4. Payroll Processing

We process payroll for all employee types (full-time, part-time, temporary, and contract staff) by:

5. Compliance and HMRC Tax Management

We handle all tax calculations and submissions, ensuring full compliance with HMRC regulations. This includes:

- PAYE, National Insurance Contributions, and Apprenticeship Levy calculations

- Submitting auto-enrolment declarations, notifications, and reports

- Preparing and submitting tax forms like P45s, P60s, and P11Ds

- Direct communication with HMRC to handle tax filings, inquiries, and ensure timely submissions

6. Pension auto-enrollment and Benefit Management

We manage all aspects of pension auto-enrollment, including assessing employee eligibility, calculating contributions, and submitting data to your pension provider, ensuring compliance with The Pensions Regulator’s requirements.

7. Freelancer and Contractors Payments

We handle payment for freelancers and contractors on your behalf, ensuring accurate legal classification and tax treatment. We can assist with:

- Correct legal classification

- IR35 legislation and tax compliance

- Payment processing and liaison

- VAT consideration (if applicable)

8. Director Payroll

If you’re seeking expert director payroll services, we offer a comprehensive solution tailored to your unique needs, including payroll processing, specialised NIC calculations, flexible salary structuring, dividend guidance, and full HMRC compliance support.

9. Year-End Process

We handle year-end tasks, including P60 generation and submission of final Full Payment Submission (FPS) to HMRC.

10. First Time Payroll Setup

We deliver full service for clients setting up payroll for the first time in the UK including:

- Registration with HMRC, documentation, PAYE scheme, and liaising with HMRC as your payroll agent

- Setting Up payroll System and software configuration

- Employee registration and documentation

- Setting up PAYE and deductions

- Setting up pension scheme auto-enrollment

- Defining pay elements

- Real time information (RTI) reporting

- Payroll processing

11. Ongoing Support and Updates

We continuously support you with payroll related questions, issues, and system updates.

12. Compliance and Record-Keeping:

We maintain accurate records for all payroll transactions to ensure compliance with HMRC regulations and facilitate audits. This includes keeping employee records up to date regarding changes in personal circumstances that may affect payroll.

13. Security and Confidentiality

We prioritise protecting your sensitive payroll data through advanced security measures and strict compliance with data protection GDPR and other regulation. This includes encryption, secure transfers, restricted access, and regular audits, ensuring your information is always handled securely and confidentially.

14. Reporting and Analysis

We offer insightful payroll reports and analysis to help you make informed business decisions.

15. Payroll Review Services

We offer payroll review services to identify discrepancies, errors or compliance issues.

Why Choose

Us?

Us?

Expert chartered accountants managing complexity of payroll

Up-to-date and compliant with latest regulation

First time payroll setup

Fully outsourced or hybrid model

Technology-Driven solutions

Secure and Confidential payroll management

Frequently Asked Questions and Answers

Auto-enrolment is a UK government requirement for employers to automatically enrol eligible workers into a workplace pension scheme. Employees aged 22 or over, earning more than £10,000 annually, must be enrolled, with both employers and employees making contributions. The minimum total contribution is 8% of qualifying earnings, with at least 3% from the employer. Employees can opt out, but they must be re-enrolled every three years. Employers are responsible for ensuring compliance with The Pensions Regulator’s rules.

If any errors are made, such as overpayment or incorrect tax deductions, we can help rectify them by processing adjustments in the next payroll cycle or making necessary amendments. We’ll also ensure that the correct information is resubmitted to HMRC.

We offer flexible payroll scheduling based on your business operation needs. Payroll can be processed weekly, monthly, or on any custom schedule you prefer.

Directors can be paid via PAYE, where they are both employer and employee. NICs are calculated differently, using either the standard annual method for irregular pay or the alternative method for regular pay. Payments and deductions must be reported to HMRC through Full Payment Submissions (FPS).

Directors who are shareholders can also receive dividends from company profits, which are subject to income tax but not NICs.

Directors aren’t required to receive the National Minimum Wage and often combine PAYE salary with dividends for tax efficiency. All payments must go through PAYE or dividends, not personal withdrawals. Consulting Accountant Globe is recommended for optimal tax planning.